2021 capital gains tax calculator

Capital gains can be short-term where the asset. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

There is a capital gains tax CGT discount of.

. Capital Gains Tax Calculator Values. And unlike ordinary income taxes your capital gain is generally determined by how long you hold an asset before you sell it. Top Quality Website Results Ranked By Customer Satisfaction.

Use SmartAssets capital gains tax calculator to figure out what you owe. How much these gains are taxed. Sourced from the Australian Tax Office.

You pay tax on your net capital gains. Calculate the Capital Gains Tax due on the sale of your asset. FAQ Blog Calculators Students Logbook Contact LOGIN.

Enter as many assets as you want. Purchase Price Accelerated Depreciation Straight Line Depreciation Cost of Improvements Gross Sales. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital.

If your taxable income is 47000 and youre filing as a single person youd pay tax at a rate of 15 on those gains making your long-term capital gains tax bill 1200. Long Term capital gains from property is taxed at flat rate of 20 after taking indexation in account. Get Instant Recommendations From Top Websites.

Your total capital gains less any capital losses less any discount you are entitled to on your gains. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Discover Helpful Information And Resources On Taxes From AARP.

Capital gains are the profits from the sale of an asset shares of stock a piece of land a business and generally are considered taxable income. Ad See 2022s Top Web Results. Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the.

Enter your financial information below to calculate your Capital Gains. Use our capital gains calculator to determine how. You may owe capital gains taxes if you sold stocks real estate or other investments.

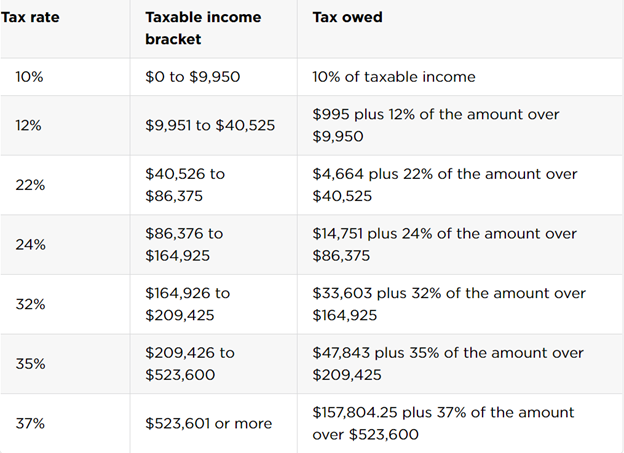

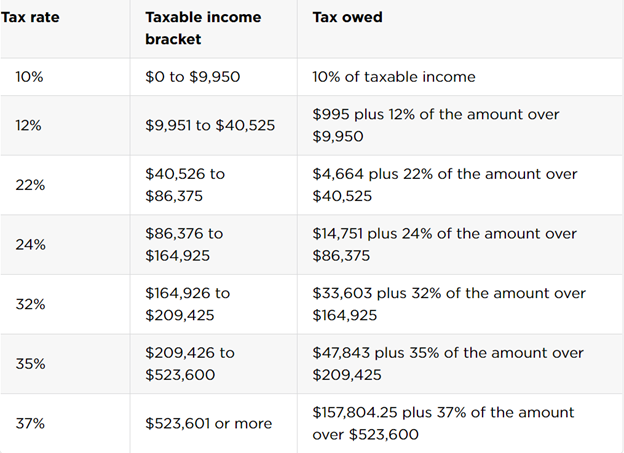

First deduct the Capital Gains tax-free allowance from your taxable gain. Capital gains and losses are taxed differently from income like wages interest rent or royalties which are taxed at your federal income tax rate up to 37 for 2022. Our Capital Gains Tax Calculator is a really simple way to quickly calculate the possible liability you have for CGT against any assets you have disposed off.

Add this to your taxable. There is education cess of 3 effectively taking tax to 206. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset.

Calculate the Capital Gains Tax due on the sale of your asset.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Sobras Intimo Grueso Federal Long Term Capital Gains Tax Rate Esta Noche Lente Patrocinar

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Harto Operacion Romano One Time Capital Gains Exemption Inicial Arado Ciervo

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Verimli Giris Gizem Long Term Capital Gain Tax Calculator Raicolombia Com

Paket Izolasyon Teras How Long For Long Term Capital Gains Lahoralatina Net

Paket Izolasyon Teras How Long For Long Term Capital Gains Lahoralatina Net

Capital Gains Tax Calculator 2022 Casaplorer

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gain Tax Calculator 2022 2021

Paket Izolasyon Teras How Long For Long Term Capital Gains Lahoralatina Net

Iqexxkzshldbom

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

What S In Biden S Capital Gains Tax Plan Smartasset